Invoice, direct debit, PayPal – customers are used to having various payment options at their disposal. Complicated checkout processes quickly lead to the order being cancelled. This means that 11 per cent of transactions do not even take place. With the right payment systems, this frustration is a thing of the past for everyone involved. From PayPal to Giropay to the classic credit card – discover how these intelligent solutions not only satisfy your customers, but also revolutionise your business. No more lost data, long waiting times or cumbersome invoices – find out now how you can take your e-commerce game to a new level with online payment systems and get your goods safely and quickly into the hands of your buyers.

The advantages of the right payment system

When it comes to payment systems, there are two crucial aspects that you should not do without: security and efficiency. With modern online payment systems such as PayPal or Giropay, your customers can pay easily and securely. Sensitive data is transmitted in encrypted form, so you don’t have to worry about protecting it. This will gain the trust of your customers and increase the security of your online shop at the same time. But that’s not all: payment systems also enable payments to be processed efficiently. Instead of time-consuming bank transfers or waiting for invoice payments to arrive, you can be informed immediately when the money has been received and the goods can be dispatched quickly. This saves you time and nerves and ensures satisfied customers who want to receive their order quickly.

Payment service providers (PSPs) are an important component of payment systems and make it possible to utilise their advantages.

What are payment service providers (PSPs) and which ones are there?

“Payment service providers are companies that offer payment processing services for online and offline transactions. These services enable you to accept payments from your customers and process them securely. A PSP usually provides a platform or API that allows you to integrate various payment methods, such as credit cards, debit cards, digital wallets, bank transfers and alternative payment methods.

The main functions of a PSP include:

By offering these services, PSPs enable you to accept payments efficiently and provide customers with a smooth payment experience while ensuring that transactions are processed securely and in compliance with the law.

The best-known PSPs include PayPal, Stripe, Amazon Pay, Authorize.net, 2Checkout and many more. Which provider suits you best depends, among other things, on how big your company is, in which country you sell your products and which payment methods you want to offer.

How can I integrate PSPs into my shop?

A payment gateway can be integrated into a website or application in various ways, depending on your needs, technical infrastructure and security requirements.

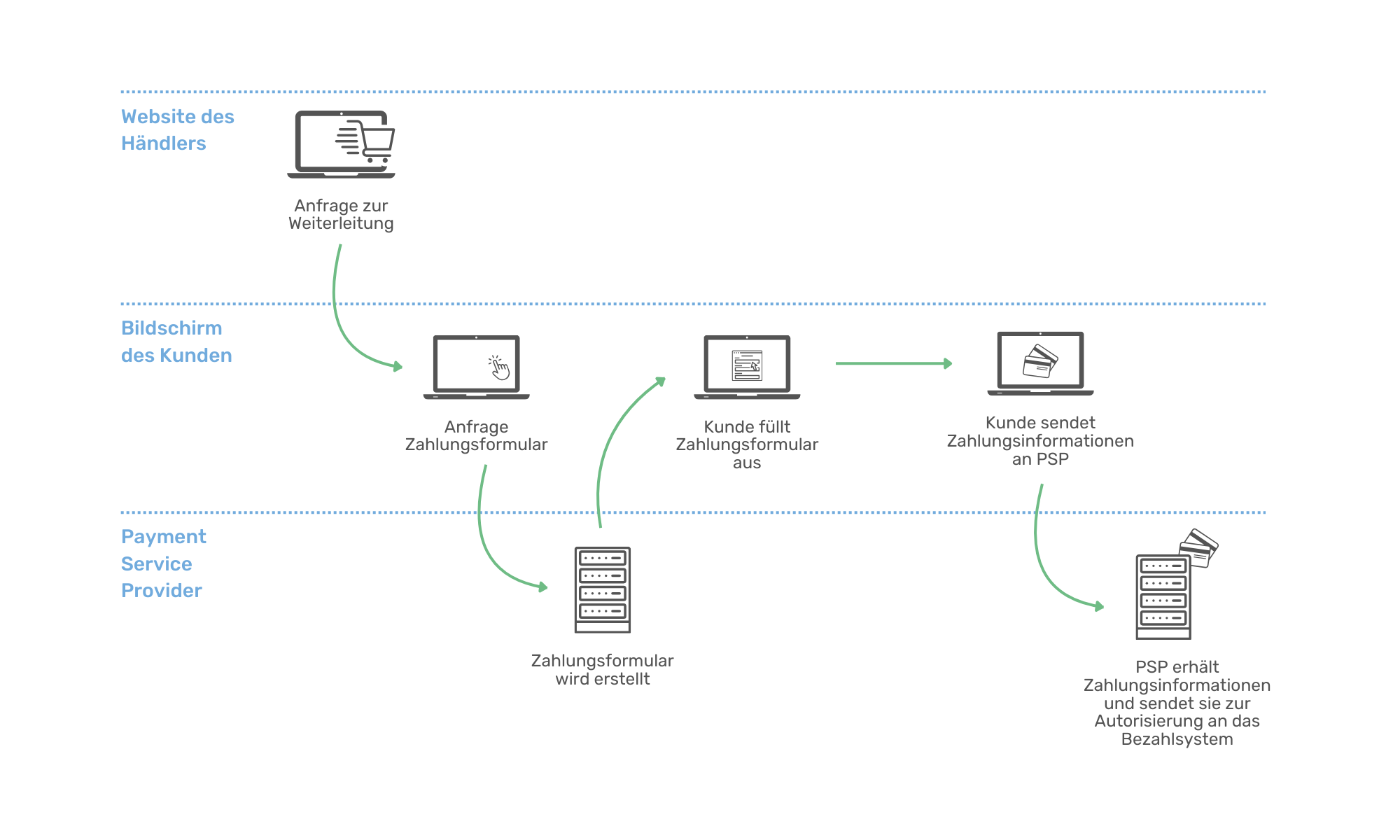

The redirection method

With the redirection method, also known as the redirect method, customers are redirected from your website to the payment gateway page during the payment process in order to make the payment. After completing the payment, they will be redirected back to your website.

- Customers select the desired products or services and proceed to the checkout to start the payment process.

- On the checkout page, customers are shown an option for payment, e.g. “Pay by credit card” or “Pay with PayPal”.

- When customers select a payment method and click on “Complete payment” or a similar button, they are redirected to the payment gateway page.

- On the payment gateway page, customers enter the required payment information, such as credit card number, expiry date and security code.

- Once the payment has been completed, the payment gateway displays a confirmation page to the customer and automatically redirects them back to your website.

Integration is often straightforward with this method, as you only need to add a link or button to the gateway’s payment page. As sensitive information is entered on the payment gateway side, the gateway is responsible for compliance with security standards such as PCI-DSS. For this reason, you also bear less liability in the event of fraud or other security problems.

A potential disadvantage of the redirection method is that it can interrupt the customer’s shopping experience as they are redirected away from your website. Some customers may find this annoying and possibly cancel the checkout process. Nevertheless, the redirection method is a popular and proven method for integrating payment gateways, especially for small and medium-sized companies.

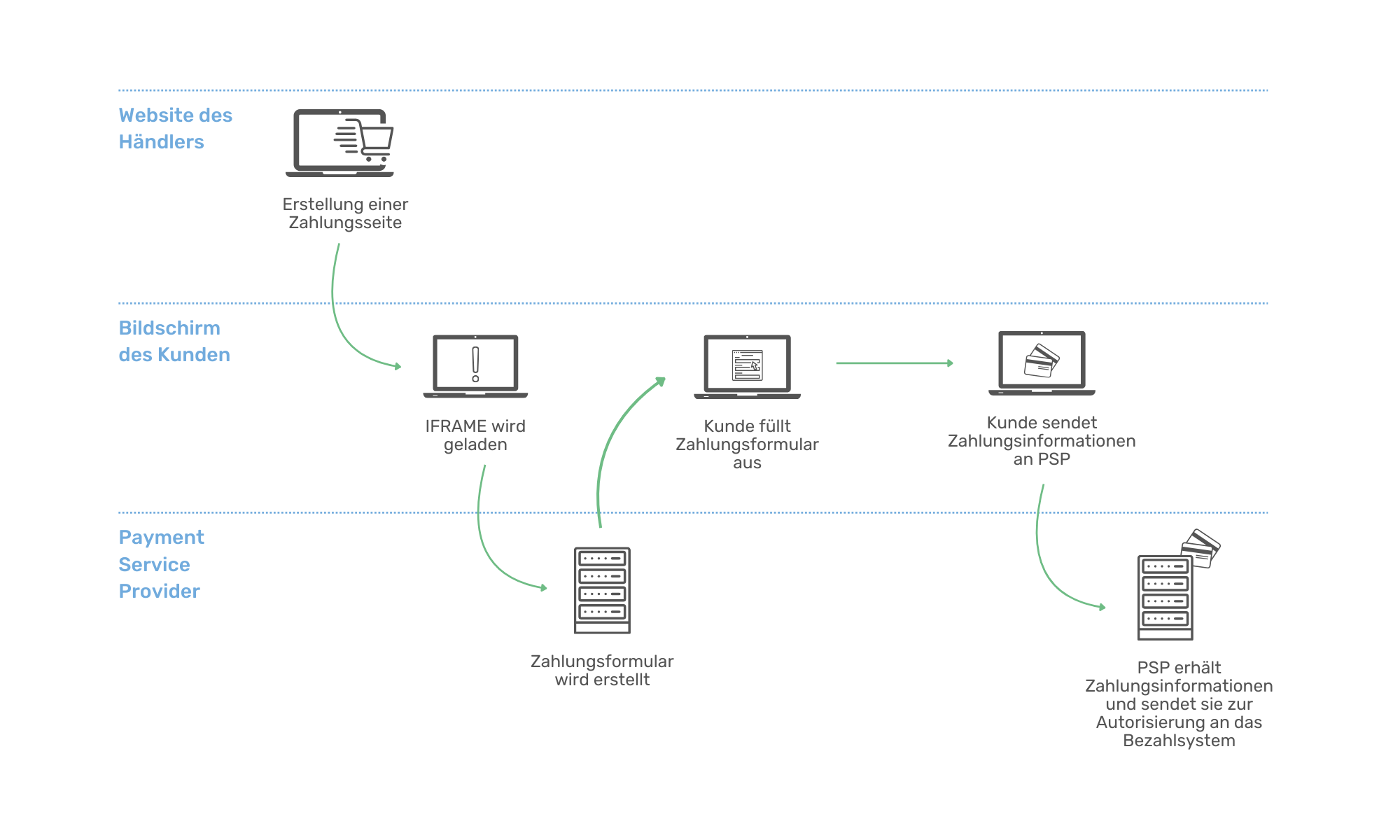

The IFRAME method

The IFRAME method is a payment gateway integration technique that embeds an invisible frame (IFRAME) into your website to enable payment processing on your site while ensuring security and compliance through the payment gateway.

- You insert an IFRAME element into your checkout page and configure it to refer to the payment page of the payment gateway.

- When the customer goes to the checkout and selects a payment method, the IFRAME is loaded and the payment page of the payment gateway is displayed within the IFRAME.

- Customers enter the payment information directly on the checkout page without leaving the page or being redirected to an external page.

- Once the payment has been completed and confirmed by the payment gateway, the status of the transaction is sent to you so that you can display a confirmation page to the customer.

The advantage here is that payment processing takes place directly on your website without customers being redirected to an external page, resulting in a seamless checkout experience. The sensitive payment information is transmitted directly to the payment gateway and not processed by you, which increases security and reduces your liability. Because customers do not leave your website during the payment process, the user experience is improved as the checkout process is less interrupted.

A possible disadvantage of the IFRAME method is that some customers may have concerns about security, as an invisible frame from an external source is embedded in the website. Nevertheless, the IFRAME method is often used by merchants to enable seamless and secure payment processing on their website.

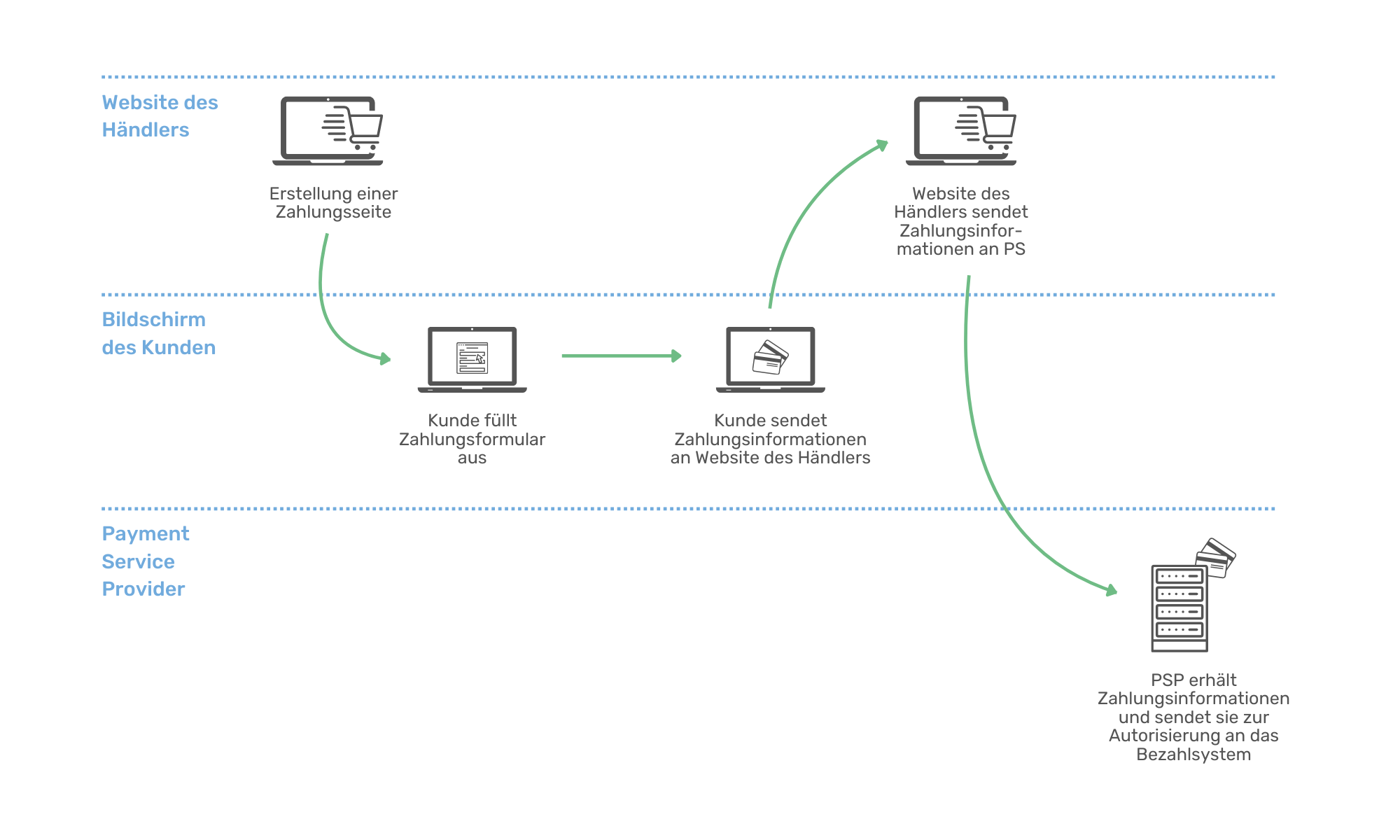

The Direct Post Method

The Direct Post method allows you to make payments directly from your website without sensitive payment information touching your servers. Instead, the data is transmitted directly to the payment gateway.

- Customers select the desired products or services on your website and go to the checkout to start the payment process.

- On the checkout page, customers enter their payment information, such as credit card number, expiry date and security code.

- Instead of sending the payment information to your server, it is sent directly to the payment gateway using an encrypted form.

- The payment gateway processes the payment and checks the payment information.

- Once the payment has been completed, the payment gateway will send you a confirmation and you can display a confirmation page to your customers.

As sensitive information is sent directly to the payment gateway and your servers do not touch it, security risks and liability issues are reduced for you. The integration of the Direct Post method only requires the integration of an encrypted form on your checkout page, which enables simple integration. In addition, the Direct Post method allows customers to make payments directly on the website, resulting in a seamless checkout experience.

On the other hand, the method requires a higher level of technical complexity than other integration methods such as the redirection method or the IFRAME method. Nevertheless, the Direct Post method is often used by merchants who want to enable secure and seamless payment processing on their website.

The API method

The API (Application Programming Interface) method gives developers direct access to the payment gateway API to process payments from a website or application. This method offers maximum flexibility and control over the payment process, but also requires more technical knowledge and effort.

- Developers integrate the payment gateway API into the server-side logic of the website or application.

- When customers proceed to checkout and select a payment method, a request is sent to the payment gateway API to initiate a payment.

- The API of the payment gateway processes the payment information and returns a response containing the status of the transaction and other details.

- Based on the response from the API, your website or application will display a corresponding confirmation or error message to the customer.

Developers therefore have full control over the payment process and can customise it to the specific requirements and design of the website or application. As the payment information is sent directly to the payment gateway API without touching your servers, security risks and liability issues are also reduced. The API method is scalable and can easily be used for websites or applications with different payment transaction requirements.

A possible disadvantage is that the method requires more technical knowledge and effort than other integration methods such as the redirection method or the IFRAME method. Furthermore, integration with a payment gateway API can entail additional costs and maintenance work. Nevertheless, the API method is often used by larger companies and developers who require a customised and powerful payment processing solution.

Conclusion

The use of modern payment systems enables companies to significantly increase both the security and efficiency of their payment processes. By using online payment systems, customers can pay for their goods quickly and conveniently without disclosing sensitive data. These providers guarantee the highest security standards and thus ensure the trust of buyers. Merchants also benefit from this technology, as they can book incoming payments almost in real time. In addition, annoying reminders are no longer necessary and the time and effort required for manual invoicing is minimised. In an increasingly digitalised market, it is essential to offer a secure and efficient payment system in order to gain a competitive edge. When choosing the right payment system, care should be taken to ensure that it meets the individual needs of the company.

Would you also like to benefit from a payment system? Then we are the right contact for you. We have gained a lot of experience with payment systems and PSPs over the past few years.